Cryptocurrency exchanges are used by owners of digital assets to trade their cryptocurrencies, and interest in all cryptocurrencies continues to increase. Cryptocurrency exchanges should conduct transactions reliably and securely. However, there were 12 significant cryptocurrency exchange breaches in 2019 alone, with over $292 million and over 500,000 user records taken.

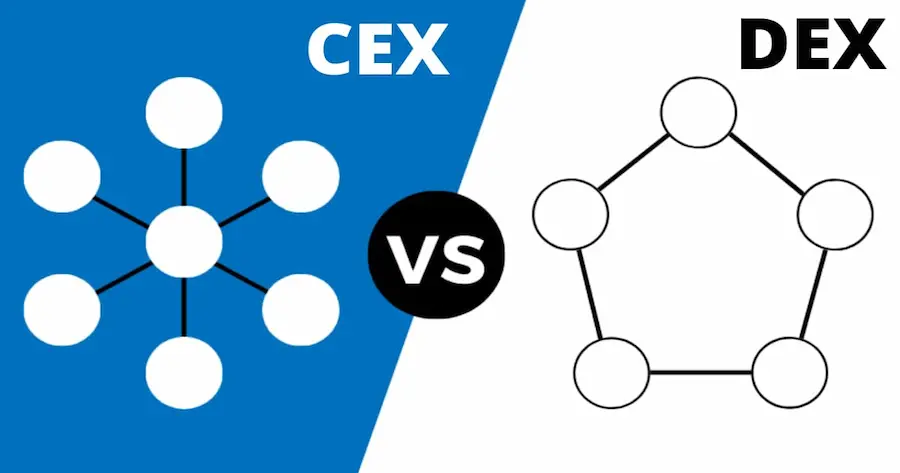

Two types of bitcoin exchanges tackle difficulties differently. A centralized cryptocurrency exchange processes transactions for a charge. Malicious CCEs may rob users of all digital assets. Even a centralized exchange with a single point of failure is vulnerable.

DEX provides customers control over their transactions. Without user trust, direct crypto trade may be problematic. Some DEXs employ third-party escrow. Scalability and privacy difficulties may arise with this technique.

Implementing the atomic exchange protocol is a more complicated solution. It aims to safeguard transactions between skeptics. With an atomic swap, participants keep full control of their cryptocurrency throughout the deal, eliminating the risk of hacking when an exchange acts as a middleman.

Table of Contents

Centralized Cryptocurrency Exchanges: What It Is?

Centralized crypto exchanges are online marketplaces for buying and selling cryptocurrencies that are managed by a centralized authority. Binance, Bittrex, and Coinbase are the most notable CCEs.

CCEs, unlike decentralized exchanges, may facilitate both fiat-to-cryptocurrency and crypto-to-fiat trading.

These exchanges are centralized in that a single entity controls the exchange and acts as a middleman between exchange participants. This implies that CCE users must have faith in the exchange to safeguard their cash. If an exchange is hacked by criminal actors or compromised by its owners, users’ funds and tokens will be lost.

Distributed Cryptocurrency Exchanges: What It Is?

Contrary to a centralized exchange, a decentralized exchange is neither owned or controlled by a single corporation or organization. Any user of the exchange may deploy a smart contract, and DEX operators have no control over it. A cross-chain DEX is essentially a source of information on current orders and exchange opportunities. It functions as a matchmaker as opposed to a trading platform.

Atomic Swaps Serve To Improve A DEX

Atomic swaps, also known as cross-chain trading, are protocols that enable the cryptographic exchange of cryptocurrencies across different ledgers. The term “atomic” indicates that the exchange either executes completely or does not occur at all. This eliminates the prospect of one side receiving payments and the other not.

HTLC, also known as the Hash Time Locked Contract, is a fundamental mechanism used in atomic swaps. This method needs a hashlock key to distribute traded crypto to consumers only after all parties have signed off on their transactions and a timelock key to securely refund traded coin to users if the exchange is not completed within the allotted time. When many currencies are submitted concurrently in these contracts, HTLCs remove the risk of a “collision by accident” by ensuring that the amount to be exchanged is guaranteed and cannot be outbid.

Atomic swaps may be used to construct decentralized exchanges that let the usage of several account systems, each with its blockchain. A DEX using atomic swaps needs a robust protocol that enables the decentralized creation of an order book so that anybody may submit a bid to buy or sell a cryptocurrency.

The purpose of the atomic swap protocol is to provide a safe exchange between users who do not trust one another.