Are You Aware That adequate knowledge of your credit score plays a very important role when it gets to borrowing loans? When your grade is low, it will be very difficult to get loans.

Good A Thing, there are top steps to go through for improving your grade. Do you want to know the best secrets to increase your rating? Then, don’t hesitate to read this article to the end.

Here’s what you will learn from this article:

- What is a credit score?

- How to check your file and fix errors

- Importance of checking your credit report

- Top 10 steps to go through for improving your grade

Table of Contents

What Is A Credit Score?

It is an assessment of your credit history and ability to manage the loan assigned. If you want to take a trip, get a house, start a business, or carry out some important projects. However, don’t have enough funds. Then, applying for a loan is inevitable. But to achieve this, your rating would determine.

Is It Necessary To Have A High Grade?

Yes, your credit score must be in the best possible grade since your financial security could depend on its strength.

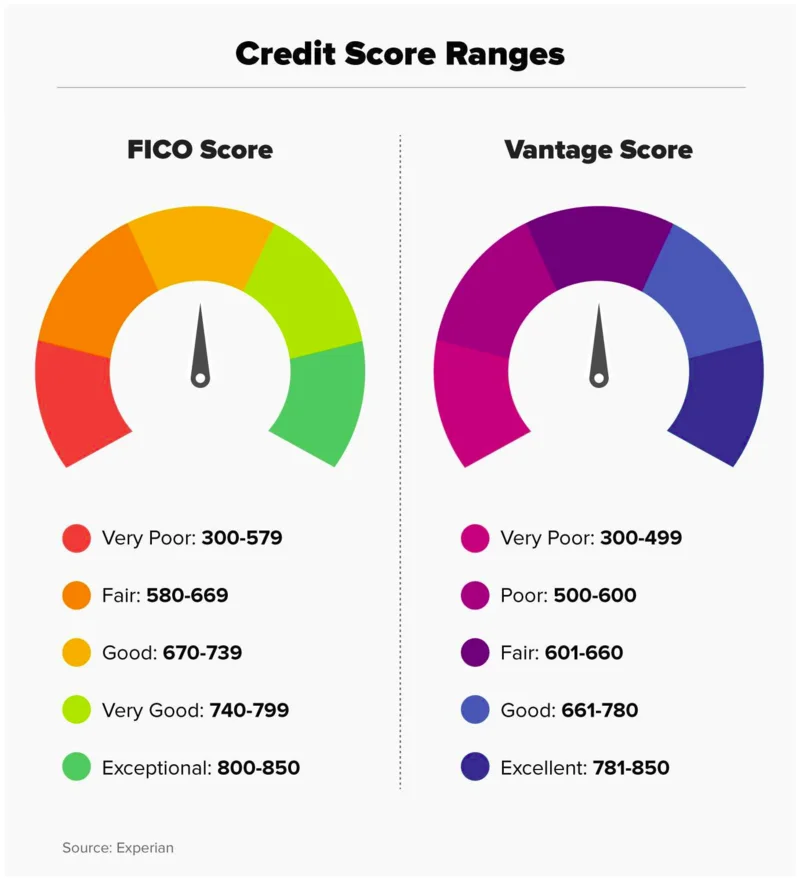

Scoring Model

According to the CFPB, grades are determined using a mathematical formula. When you have a high rating, the message is very clear for financial institutions, “you have healthy finances”. This means that you have the financial leverage to acquire the best loans.

Three Proven Ways To Evaluate Your File And Correct Errors

You can access your file by writing and sending an application to FICO. Most financial institutions use the rating given by FICO, to know who to offer loans or cards.

Another way to evaluate your rating is to visit credit karma alternative websites. It offers alternatives to access it for free.

Also, you can assess your credit report from Equifax OR TransUnion. When logged in to their websites, you’ll be given a form and instructed to fill. Afterward, you’ll add copies of requested identity documents and forward them to their website.

How Сan You Correct An Error In Your File?

Errors can be easily corrected by filing a complaint against the credit bureaus. This can be done by transmitting a written petition to the closest consumer protection office.

Is It Vital To Always Check Your Credit Report?

Yes, it’s very important. The slightest mistake in your file could tarnish your financial profile and make it difficult for you to access loans.

Four Good Reasons Why You Should Always Evaluate Your Score Are:

- To ensure that your personal information has been updated.

- To ascertain the correctness of your rating indicated in the report.

- To ensure you’ve not fallen into the problem of identity fraud.

- Knowing your rating will be very helpful when borrowing loans.

The Best Tips To Improve Your Credit Score

- Pay your credit card and other bills on time. The FICO company calculates ratings based on 30% of the amount being owed.

- Schedule all your due dates. In order not to be late with the payments, it’s recommended that you put together a payment schedule.

- Always endeavor to properly examine your credit report.

- Don’t apply for many credit cards at the same time.

- Ensure you don’t cancel abandoned cards.

- Control your expenses with your card. You must keep credit balances low. It’s recommended that you maintain a variable balance, below 10% of your total available credit. To do this, you can choose to use cash or a debit card, at least for a time.

- Maintain a variety of types of credit.

- Another way to improve your grade is, borrowing personal loans to pay off debts.

- Seek help by applying for alternative payments. Consumers with medium and low ratings can get lenders to consider other indicators of fiscal responsibility, such as regular utility or mortgage payments.

- The length of time of your credit activity is another important piece of information to determine your grade. This means that your rating gets better when you have a long time credit history.

Conclusion

- Keep in mind that an individual can have more than one credit score. It depends on the lenders or entities with whom you make the agreements.

- A good rating offers so many great privileges. It allows you to get better interest rates on your loans, borrow large sums, and even score points as a job seeker. If you’re battling with a low grade, carry out the tips discussed above to boost it.

Questions And Answers

1. Does Your Income Affect Your Rating?

No, Your Income Earnings Don’t Affect Your Grade.

2. Do Spouses Share The Same Score?

No, Spouses Don’t Share The Same Rating. Also, If The Loan Borrowed By The Spouse Is Joint, Whenever There Is A Late Payment, It Would Reflect On Both Credit Reports.

3. Can I Have More Than One Score?

Yes, It’s Possible. Agencies Don’t Certainly Get The Same Data From All Your Creditors.

Read Also: How Small Loans Affect Your Credit Score